Energy price volatility and how to manage it for electric fleets: Simon, our PPA Senior Pricing Manager shares his insights

01.

Before we begin, can you tell us a little about what you do at Zenobē?

As a Senior PPA Pricing Manager my role is to manage the Power Purchase Agreement (PPA) products and services that we have in place with our electric vehicle (EV) fleet customers. A PPA is an agreement to facilitate the sale of electricity between a supplier and an end-user (in this case between Zenobē and an EV fleet customer). I manage these agreements for our EV fleet customers as part of our turnkey electrification service, to make sure that they can access tariffs and prices that are tailored to their individual site and charging requirements. By doing this I remove a level of complexity our customers do not need, tailoring and structuring products to the individual depot and helping to manage some of the associated market risks. My focus is on reducing costs for our customers by offering long-term, short-term, variable, or fixed agreements that allow them to be more proactive and agile with their costs.

02.

What is your view on the extremely high electricity prices we are seeing? Is it a ‘blip’?

03.

So, what does an electric fleet operator need to know about energy markets?

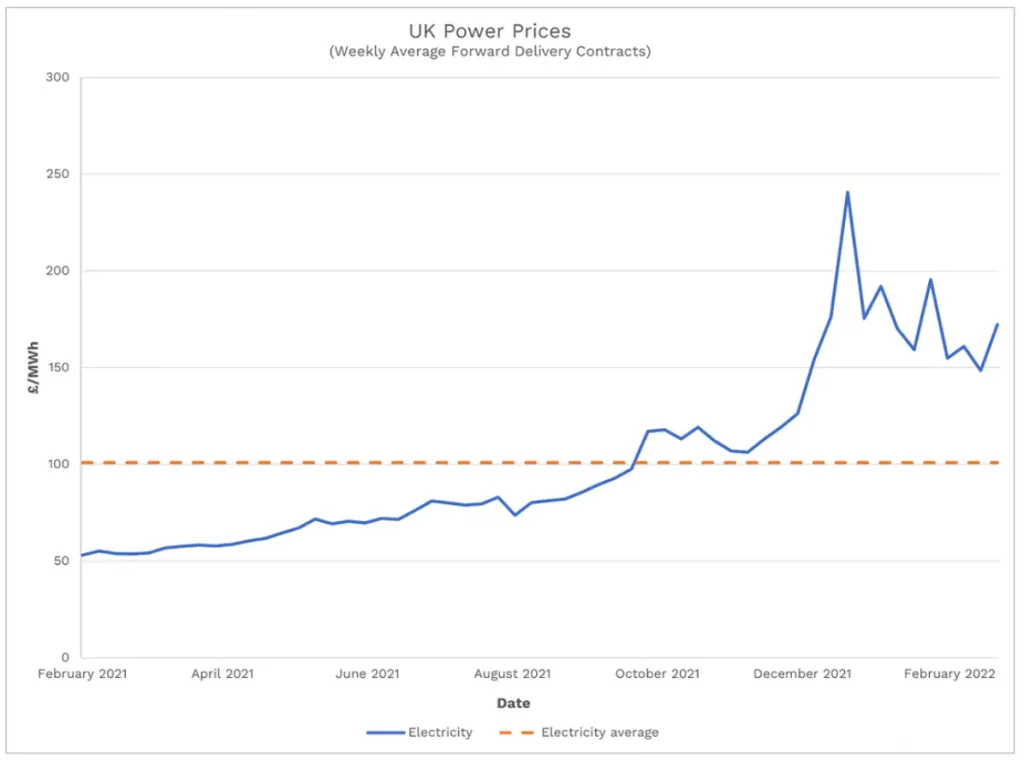

First, you need to know what the current prices available are and what the landscape looks like – is it up, down, unstable, or calm? At the moment, we’re in a remarkably high market. Energy prices, just like fuel prices, are volatile and can present a core commodity risk to many transport and logistics businesses running electric fleets. The right power procurement and charging strategies will mitigate these risks so it’s important to consider these – we have more information here.

Secondly, you need to know your risk profile and flexibility. Consider whether you can risk exposure to the wholesale electricity market. Would a variable rate that flexes with the market, or a fixed price be better? Is your depot flexible in terms of when you can charge your vehicles? If you have a large window to charge in you can be flexible, but if it’s shorter you will be more limited in the rates available which will have an impact on your operating costs.

04.

What do current energy prices mean for the Total Cost of Ownership (TCO) of an EV?

As mentioned, for EV fleet operators who have invested in electric, it’s important to consider longer term forecasts of energy prices and not just the prices we are seeing now. The TCO of an EV fleet is heavily dependent on energy costs.

It’s also important to remember that EVs, batteries and charging structure are flexible by design. This flexibility gives us a toolkit to protect customers from high energy costs: Through PPAs that insulate customers from volatile wholesale electricity prices, but also through other power procurement strategies including smart charging and onsite battery storage.

05.

Can you have a PPA for renewable energy only?

Yes. At Zenobē we see clean transport as intrinsically linked to the energy transition and so we only purchase renewable energy on behalf of our customers. This is evidenced by Renewable Energy Guarantee of Origin (REGO) certificates, administered by Ofgem (the industry regulator) for every MWh of electricity we buy.

06.

And what about the wind farm that's being built down the road, can I get my energy from there?

Technically yes, and it is certainly an option we would be able to investigate for our customers. Known as Corporate Power Purchase Agreements (CPPA) or Sleeved PPAs, these agreements allow businesses to buy renewable energy from a specific generator. With 15 years experience in the renewables sector, our PPA team has experience structuring these kinds of agreements.

A primary element to consider is that this kind of PPA requires energy to be purchased over an extended period, and for the depot’s demand profile to match that of the local generator – in the case of wind power, we have learnt over the past year that this isn’t always reliable!